Camco's Impact in 2021

Our Commitment

Welcome

Camco works to transform investment into sustainable, clean and inclusive infrastructure in emerging markets, making communities and their environments more resilient to climate change. We are doing this by demonstrating to investors that, over time, clean energy and infrastructure investments can provide better risk-adjusted financial returns than other investment options. And being cost-effective, these are also the investments most likely to lead to economic growth in those markets.

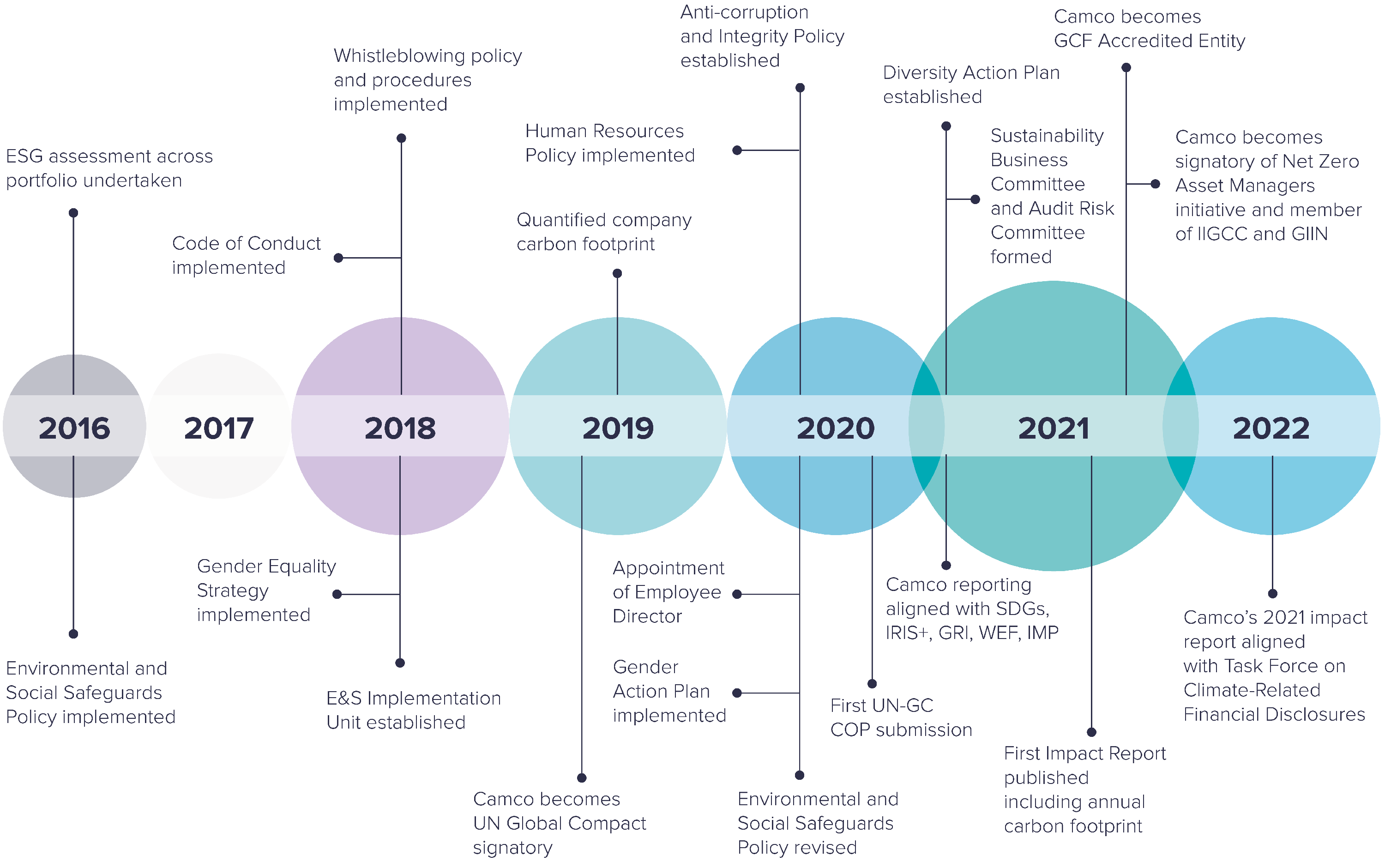

This report is Camco’s second annual impact report. We joined the Net Zero Asset Managers initiative in November, so this is our first report that is aligned with the disclosure recommendations of the Task Force on Climate related Financial Disclosures (TCFD). It also serves as our third Communication on Progress to the UN Global Compact, which we signed up to in April 2019.

2021 has been a busy year for Camco – just as it has for the climate world in general - and as you will see in this report, there have been many new developments both at a company level and through the funds that we manage.

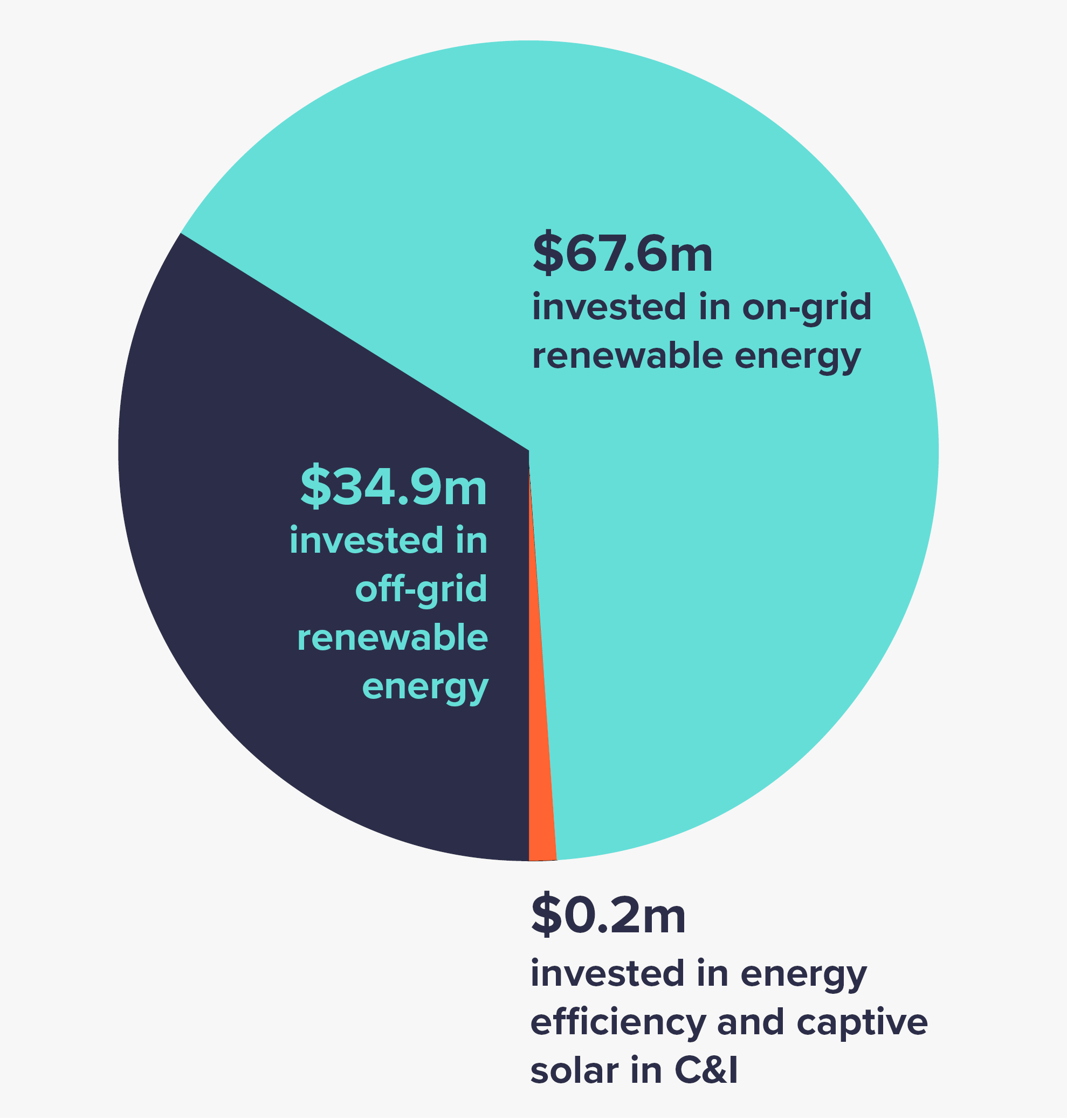

The USD 200m UK government-funded Renewable Energy Performance Platform (REPP) continues to deliver transformational impact via the projects that it invests in. Spark Energy Services, the innovative USD 100m finance company we launched last year to support the deployment of captive generation and energy efficiency initiatives in Africa’s C&I sector, is gathering pace with several development partners now signed up, two projects completed with our USD 3m seed facility, and progress being made on the full fundraise. And in the Pacific, our new climate investment platform, TIDES (Transforming Island Development through Electrification and Sustainability), is fundraising for USD 100m to support a 160+MW pipeline of remote island electrification, C&I and grid-connected renewable energy and energy efficiency projects.

Away from our day-to-day operations, we have continued to cement our position as an industry thought leader, regularly contributing at high-profile events, including COP26, where we participated in several on- and off-site panel discussions to further the conversation around climate finance and accelerate clean energy innovation.

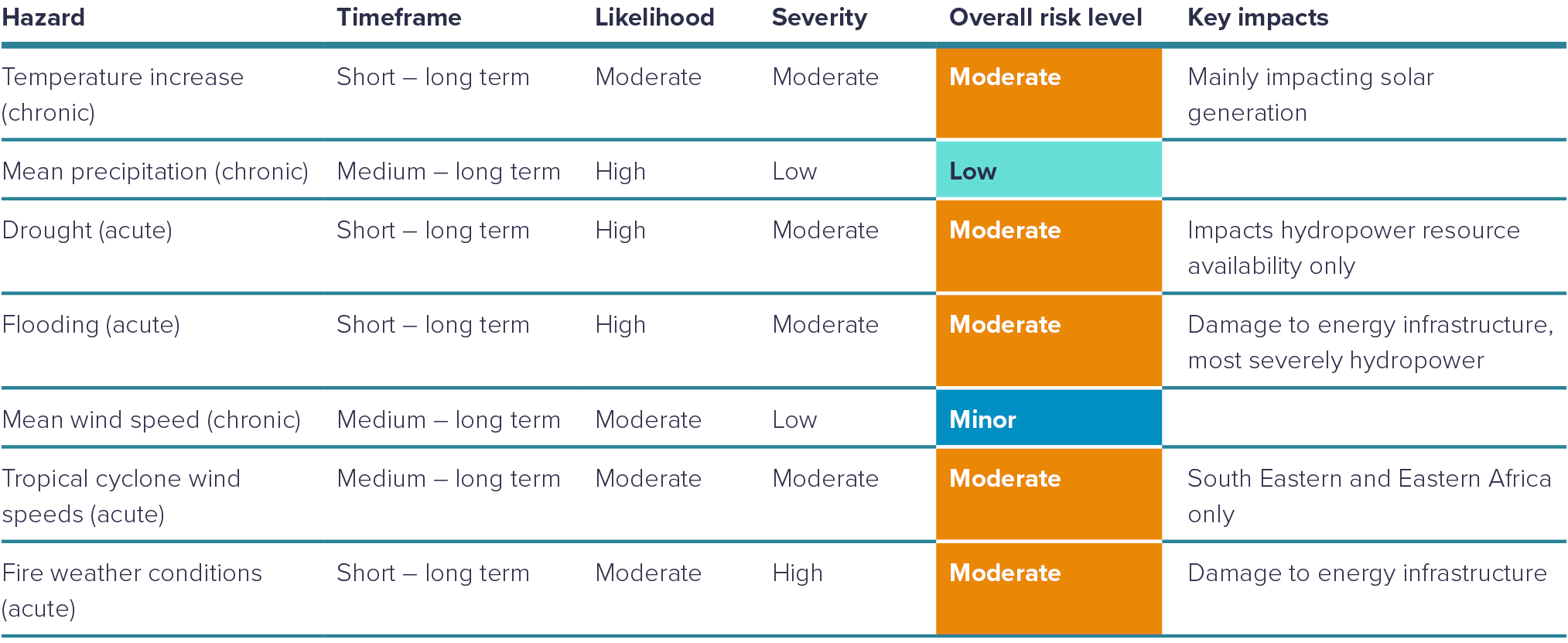

As a climate and impact fund manager, we recognise the huge responsibility and opportunity we have for supporting both the Paris Agreement climate targets and the Sustainable Development Goals. To that end, in 2021 we undertook an Impact extensive mapping exercise of REPP’s investments against country needs and priorities as embodied in their Nationally Determined Contributions (NDCs) to the Paris Agreement, national climate policies, energy sector policies, strategies and action plans, and long-term development agendas, which has greatly assisted us in overall alignment with national priorities. You can read more about how we are actively working to support the SDGs in the Creating Sustainable Value section below.

Since last year we have also been assessing how we can make more of our investments to deliver the sustainable, clean and inclusive infrastructure in emerging markets that we strive for – and help others to do the same. Find out more about this under the Impact Approach section below.

I am proud of our achievements over the last year, made in large part thanks to the dedication and hard work of the immensely talented and diversly skilled people that make up the Camco team. But as we all know too well, the window of opportunity to put a halt to irreversible and catastrophic climate change is closing fast. Camco exists to help reverse and adapt to climate change and bring a brighter future for all, and we will continue to work tirelessly to make that happen.

A Year in Review

2021 was an important year in the fight against climate change. In August, the IPCC published the first part of its Sixth Assessment Report, Climate Change 2021: The Physical Science Basis, providing the most up-to-date physical understanding of the climate system and climate change. And in November, COP26 culminated with the adoption of the Glasgow Climate Pact, a package of decisions that completed the Paris Agreement’s rulebook and sets out a range of agreed items aiming to make the 2020s a decade of climate action and support.

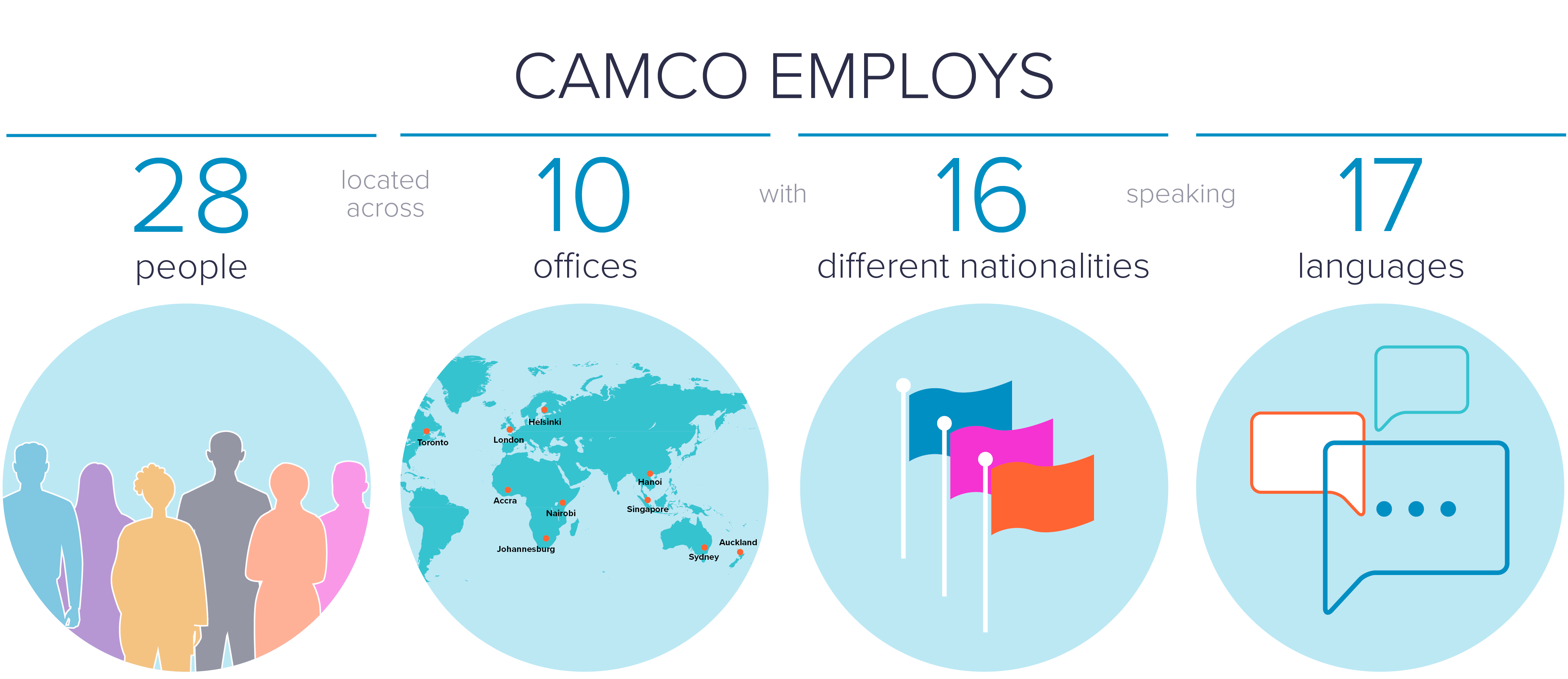

For Camco, 2021 saw another year of steady progress as the company continued to deliver on the REPP mandate while expanding into new markets and regions through Spark and TIDES. We have also welcomed several new talented and experienced recruits, who have added to the diverse skillset of the team and enabled the business to grow. Here are some of the highlights:

Camco specialises in low-carbon sustainable solutions, with 100% of assets aligned with our net zero investment strategy.

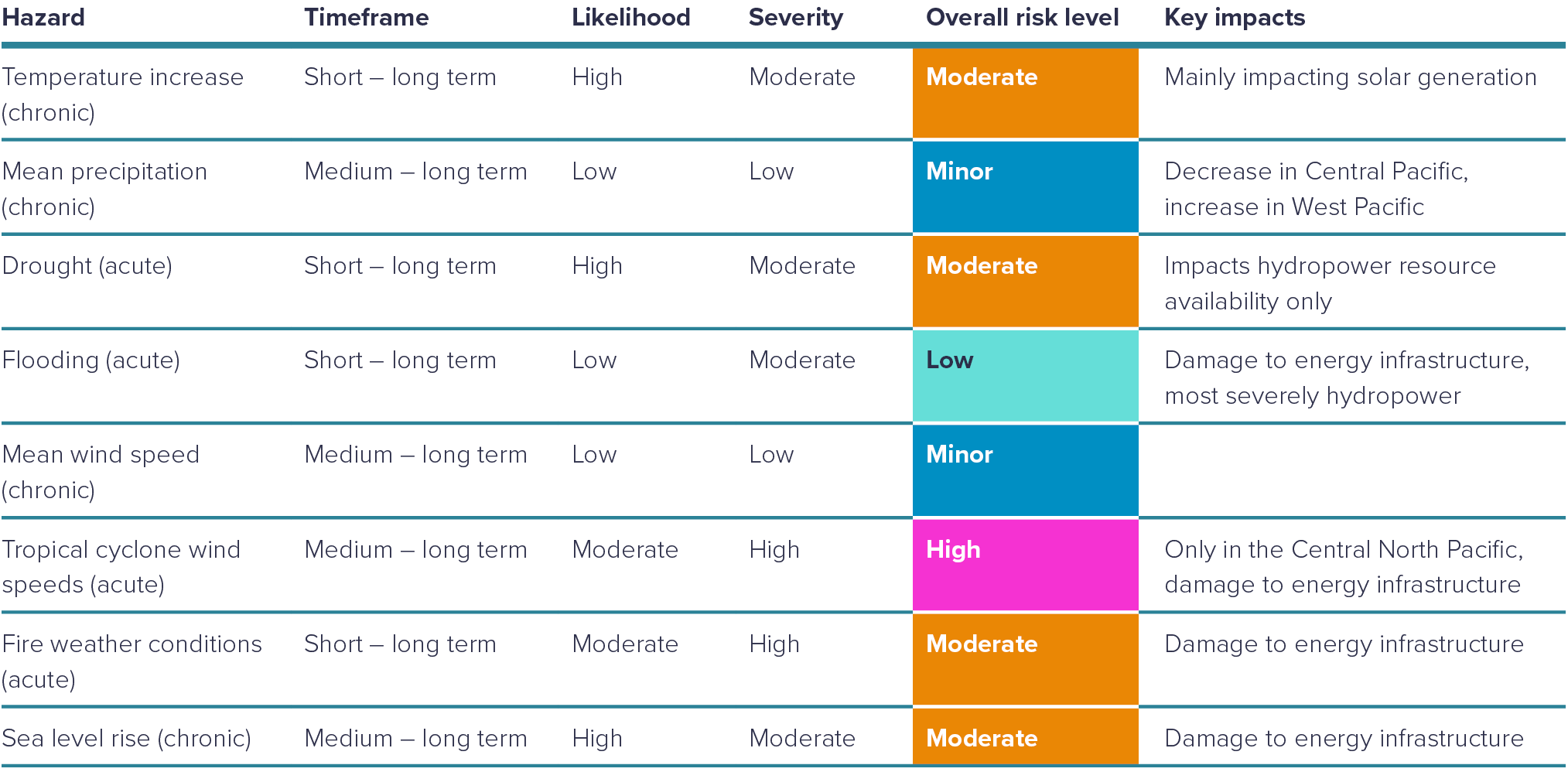

Camco has begun fundraising for TIDES, a USD 100m climate investment platform for the Pacific. TIDES aims to overcome key funding barriers for projects in the region and to enable the flow of private capital into rural electrification, commercial and industrial (C&I), and grid-connected renewable energy and energy efficiency projects. In 2021, Camco was awarded a USD 200K grant from Convergence, the global network for blended finance, in conjunction with the Australian Department of Foreign Affairs and Trade (DFAT) to develop the TIDES concept.

Camco continued to provide support to the CARICOM Development Fund (CDF) during the pilot phase roll-out of the CRAF, which is designed to facilitate enhanced access to financing for renewable energy and energy efficiency for SMEs across CARICOM member states. CRAF has now entered into two Master Guarantee Agreements with the Saint Lucia Development Bank and the Development Finance Corporation of Belize and is continuing to scale up its activities in 2022.

Camco welcomed seven new recruits over the last year, including Paul Makumbe, the founder and former CEO of Sunergise, a leading solar developer in the Pacific. Paul has been hired to lead Camco's efforts in the region, including the TIDES fundraise. Meet the team.

Camco hosted its third REPP Academy for investees of the Camco-managed Renewable Energy Performance Platform (REPP), bringing together mini-grid developers, experts and funders for insightful knowledge sharing and discussions on how to scale up the sector. In Kenya, Camco played an active role in successfully advocating the energy regulator to improve the bankability of draft mini-grid regulations. In the Pacific, Camco teamed up with Pacific Trade Invest New Zealand to deliver two investment webinars to help renewable energy developers to find and realise opportunities in the region.

Camco’s staff continued to appear regularly as guest speakers and panellists at a wide range of important industry events, from SEforAll's Youth Summit and the African Energy Indaba, to COP26, London Climate Week and a live televised debate on mini-grid regulations on NTV Kenya. General Counsel Karl Upston-Hooper was the special guest in CMIA’s first-ever Climate Investment podcast, exploring Camco’s journey in becoming a delivery partner at the GCF and providing tips and insights for industry. In June, we published the Advancing National Policy Agendas Through Responsible Investing report, providing an in-depth analysis of how REPP’s investments are aligned with the climate, energy and development priorities of the countries where it operates.

In October, we relaunched the camco.energy website to reflect the expansion of Camco’s operations into new markets and to provide an improved user experience and knowledge sharing platform.

– Financial Times and International Finance Corporation Transformational Business Awards Transformational Finance Solutions – Impact Investing 2021: Renewable Energy Performance Platform

– SME News Business Elite Awards - Best Clean Energy Investment Management Firm 2021

2021 Impact Highlights

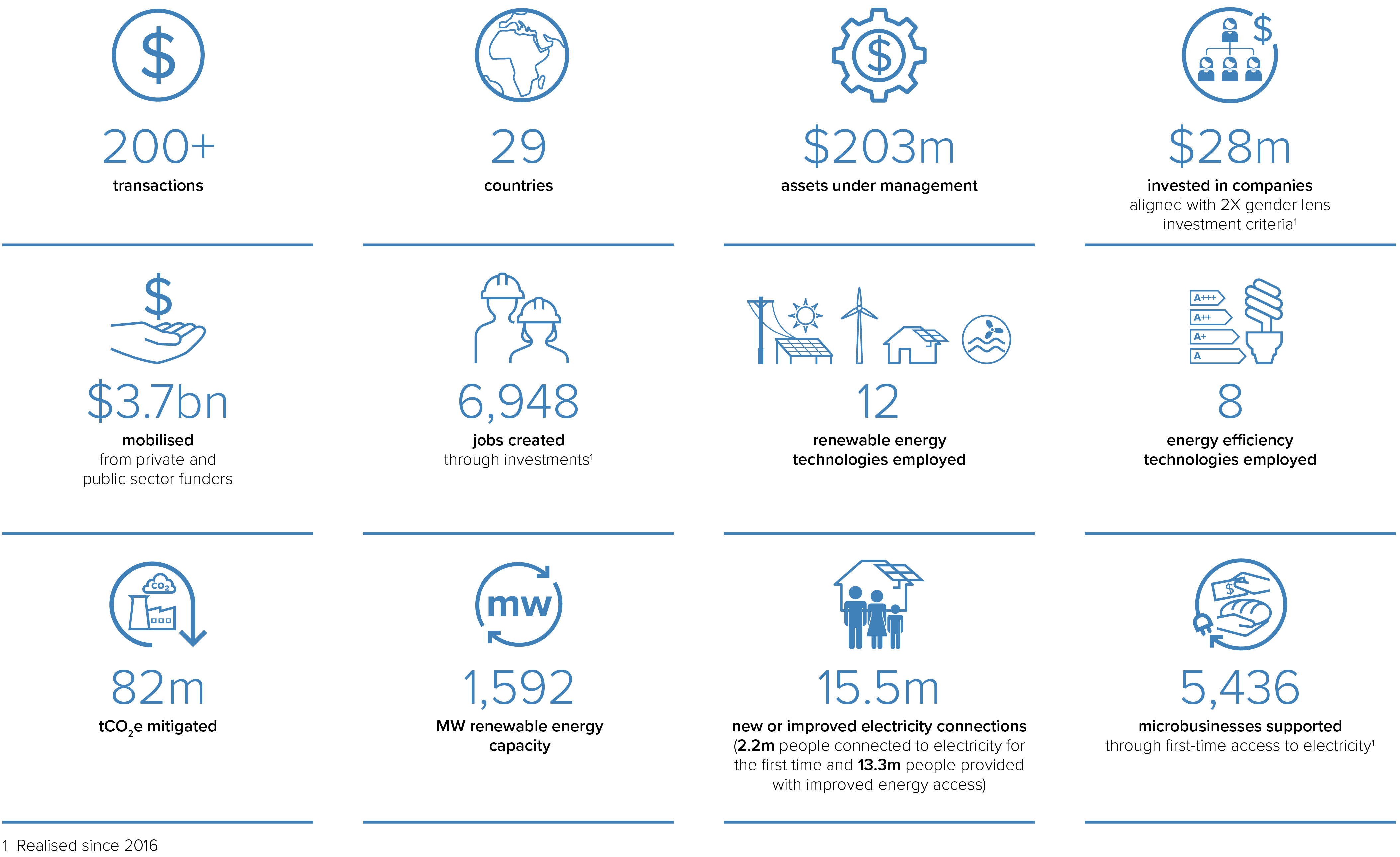

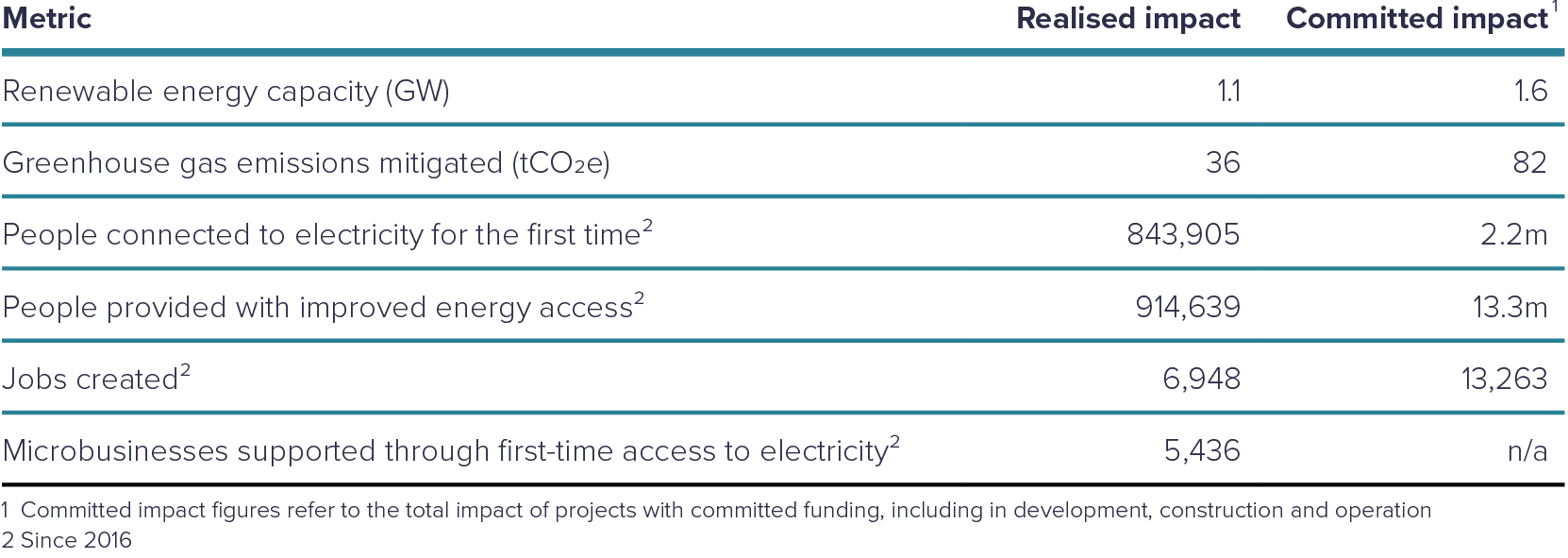

Camco's realised and expected cumulative impact

Further impact and ESG indicators are provided later in the report under Creating Sustainable Value.

Impact Approach

Camco is a climate and impact fund manager, building towards a sustainable, low-carbon future. We engage in responsible investment that incorporates environmental, social and governance (ESG) factors into investment decisions to better manage risk and generate sustainable, long-term returns.

All investment activities carried out by Camco are governed by our own policies and procedures, as well as those applying to the third-party funds/facilities that Camco manages.

Camco's investment approach:

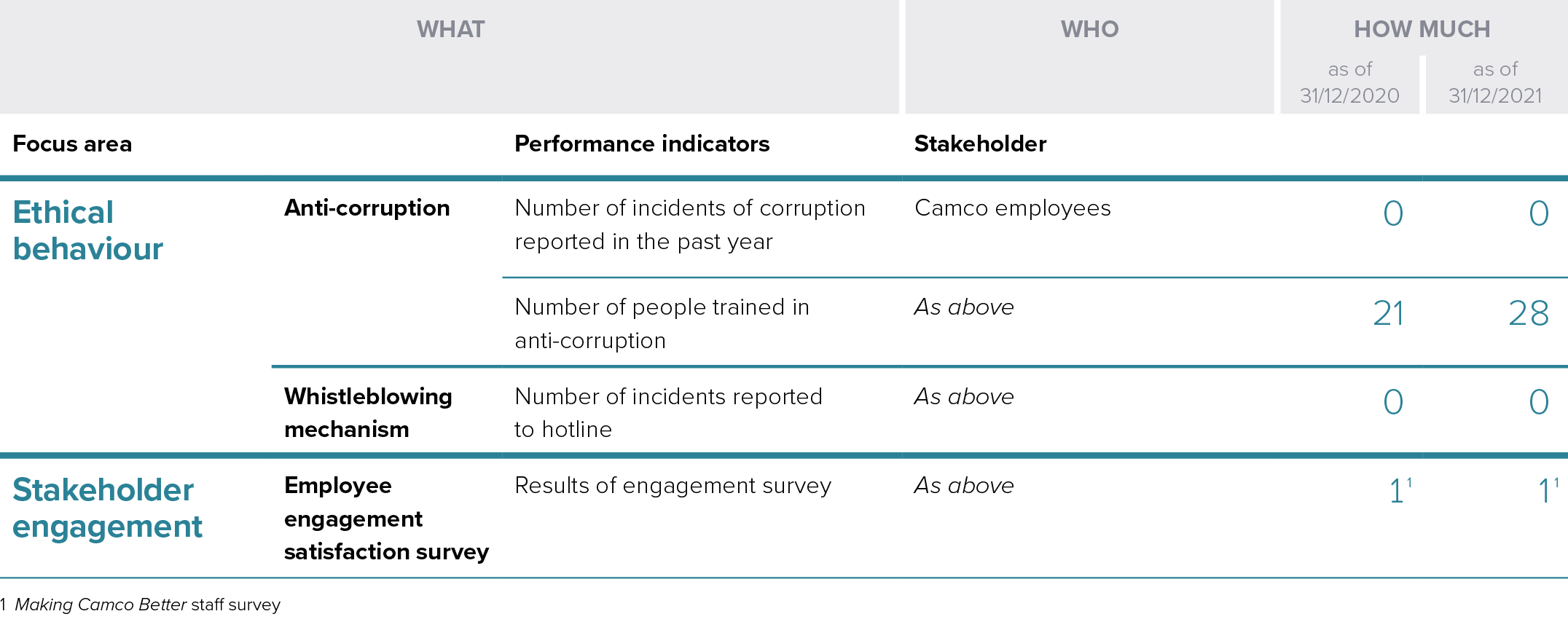

Creating Sustainable Value

Sustainability underpins everything we do and strive for at Camco. We only invest in projects and companies where negative environmental and social impacts can be satisfactorily mitigated within reasonable timescales, and only projects categorised low or medium risk - categories C/I-3 and B/I-2, respectively, according to IFC’s environmental and social categorisation - are eligible for our support. The very nature of Camco’s business means the company’s potential for negative impact on the environment is small, but the positive impact on people and planet has the potential to be significant.

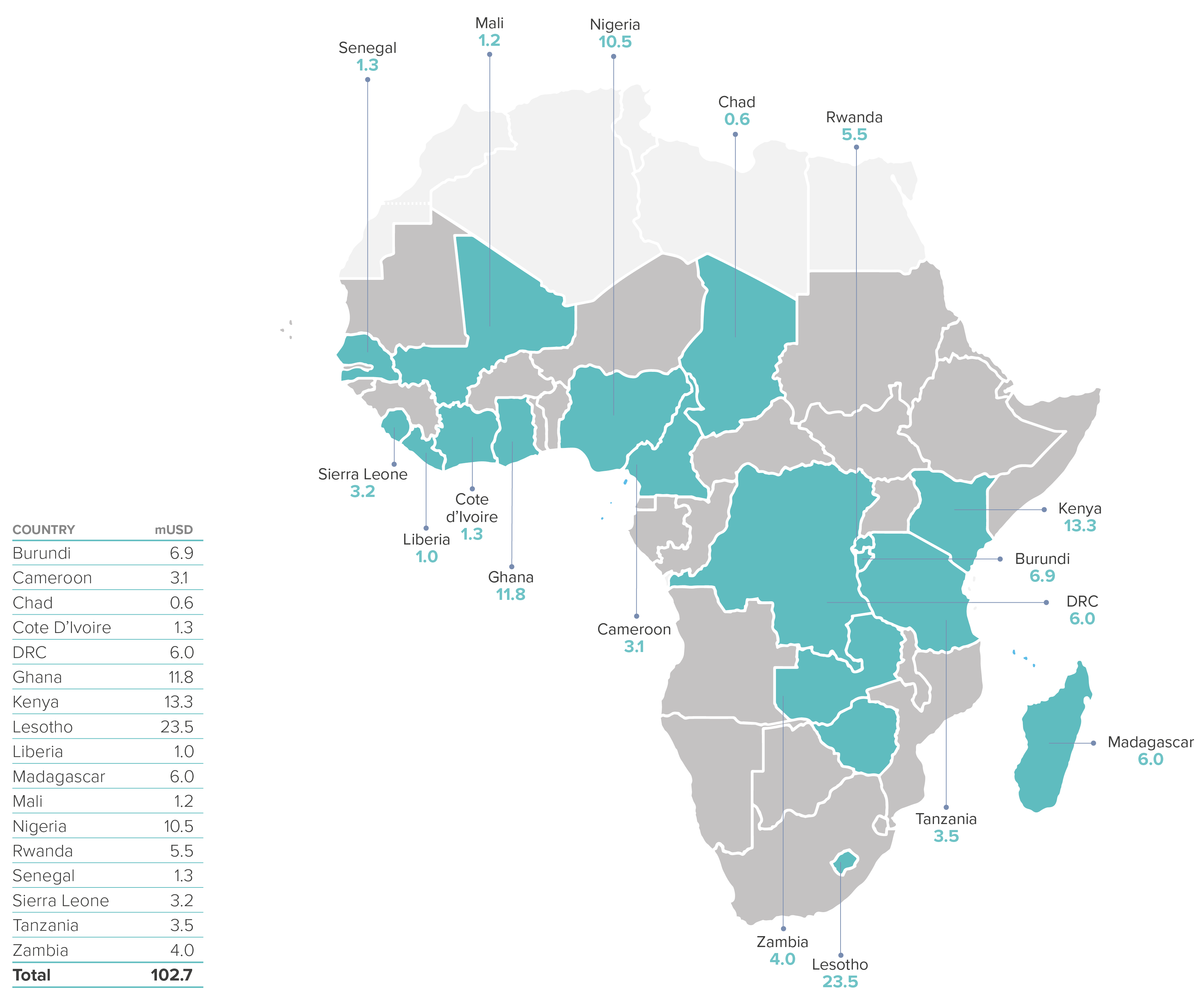

Through its management of REPP, Camco is working to stimulate the development of a vibrant, networked and viable market for small and distributed renewable energy projects in African countries. Such a market is fundamental to helping to ensure access to affordable, reliable and sustainable energy for all of the nearly 600 million people still living without electricity in West, Central, East and Southern Africa and for taking urgent climate action. The region accounts for three-quarters of all people currently without energy access in the world.

Similarly, commercial and industrial (C&I) businesses operating in Africa face major energy challenges that make it difficult to run their businesses profitably and sustainably. The Spark facility targets the efficient deployment of capital for C&I renewable energy and energy efficiency project implementation in Africa. This requires the execution of many small deals without introducing unnecessary financial risk, which it does by partnering with - and building the capacity of - suitable project developers.

As of the end of 2021, the following cumulative energy and climate impacts had been realised by Camco-managed funds and climate change mitigation projects, based on the last 30 years of operation:

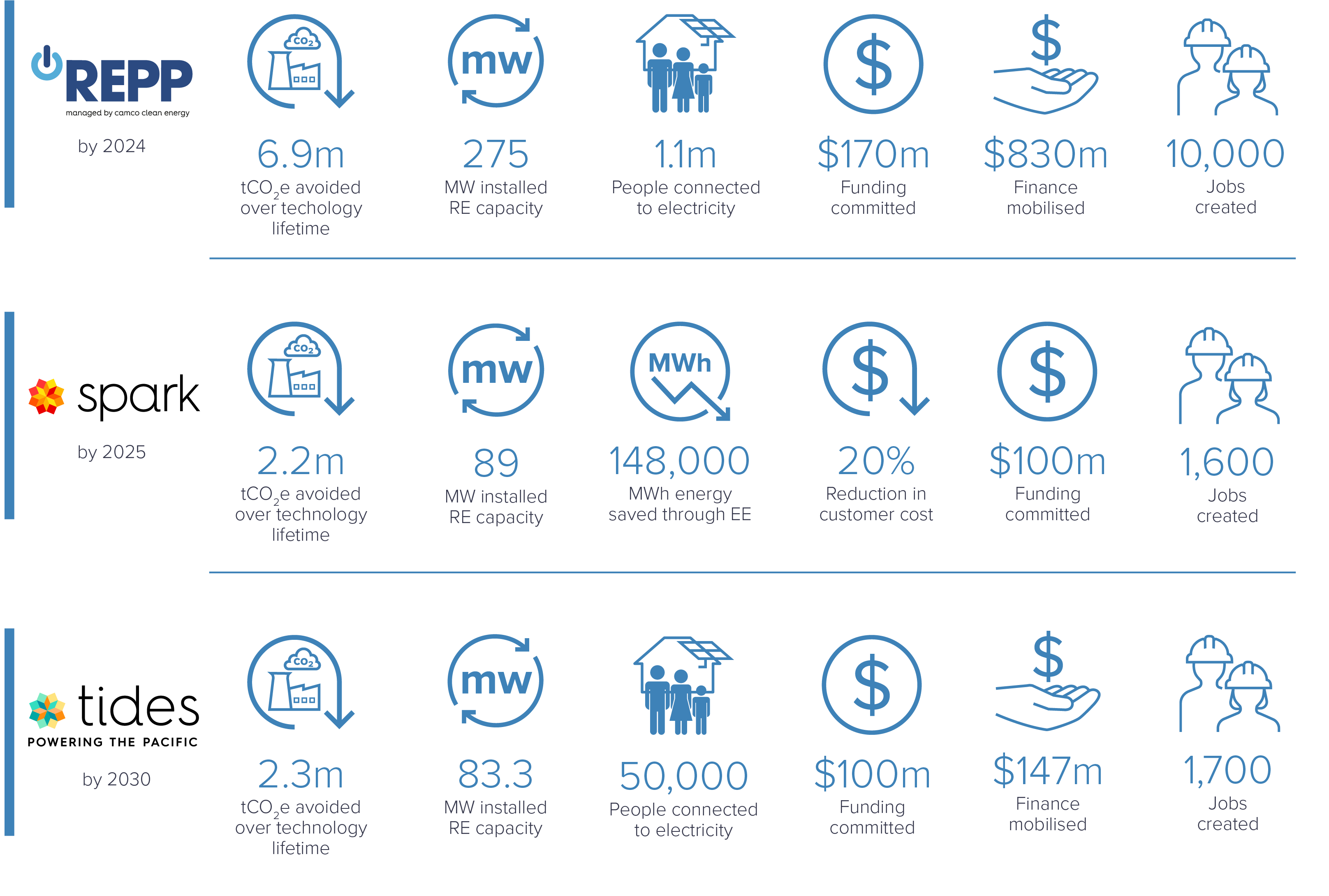

Fund-specific targets

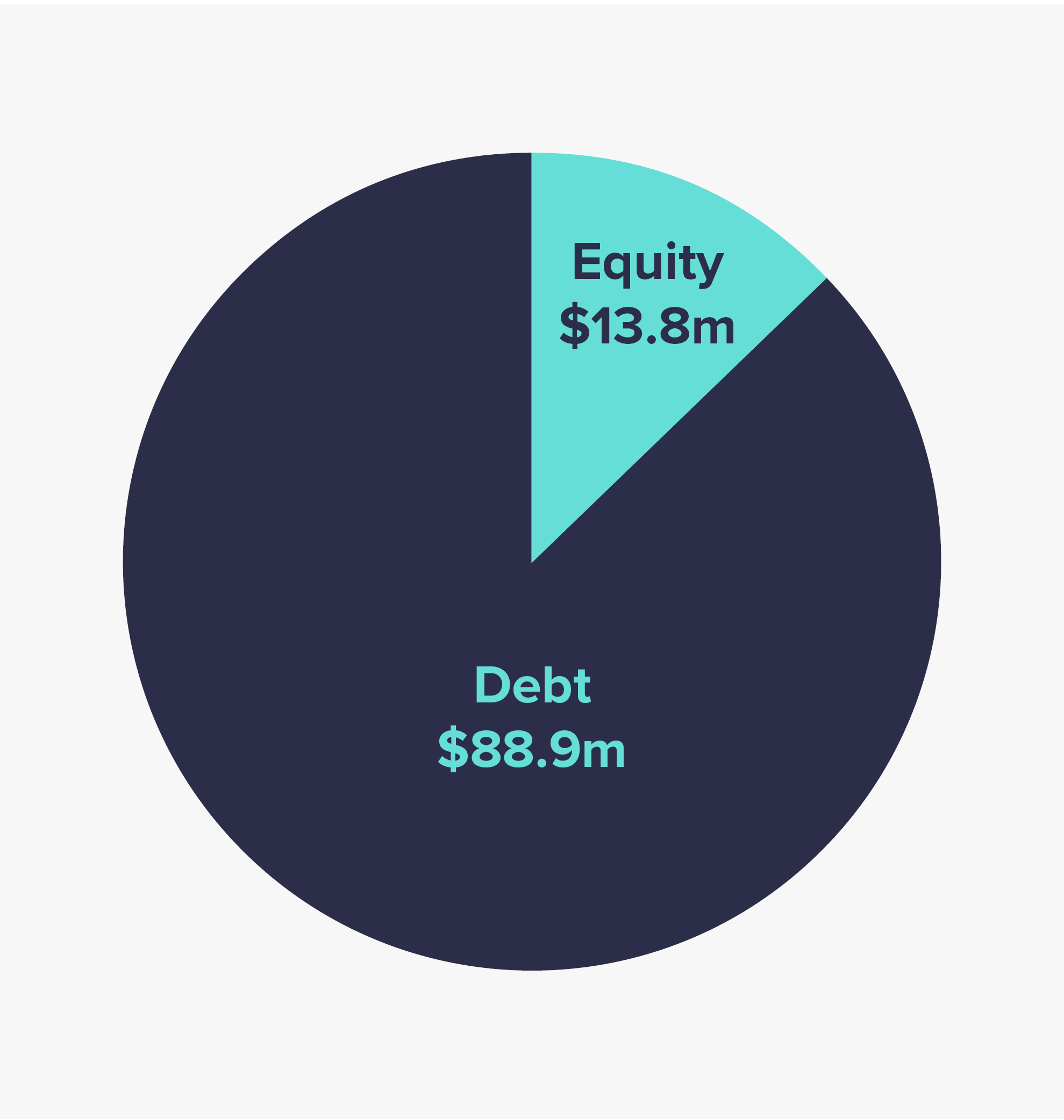

The table and investments impacts data below refer to fund-specific impact targets and results for REPP, Spark and TIDES.

The expected cost effectiveness of the mitigation actions over all three funds’ combined lifetime is 30,738 tCO2e per mUSD invested.

Camco

Camco’s contribution to SDGs

Our work primarily aims to address the following Sustainable Development Goals (SDGs):

Targets 7.1 and 7.2

By investing in innovative renewable energy and energy efficiency solutions in emerging and developing markets, Camco contributes towards access to afforbale, reliable, sustainable and modern energy for all.

Targets 9.1 and 9.4

By investing in projects to upgrade and retrofit industries to make them sustainable and resource-use efficient as well as increase the adoption of clean and environmentally sound technologies, Camco is helping to build resilient infrastructure, promote inclusive and sustainable industrialisation and foster innovation.

Targets 13.1 and 13.2

By decoupling economic growth and carbon emissions, strengthening communities’ resilience and adaptive capacity to climate-related hazards and natural disasters, and supporting the implementation of countries’ climate policies, Camco is directly supporting efforts to undertake urgent action to combat climate change and its impacts.

Camco also contributes towards the following SDGs:

Targets 1.4 and 1.5

End poverty in all its forms everywhere – by providing first-time access to electricity, decent jobs and livelihood opportunities.

Target 3.4

Ensure healthy lives and promote well-being for all at all ages – by limiting pollutants through deployment of clean technologies.

Target 5.5

Achieve gender equality and empower all women and girls – gender equality and female empowerment is a crucial part of the solution to many central development challenges, including the clean energy transition. Camco invests in women-owned or managed businesses and actively promotes gender equality and social inclusion through our diversity action plans, both internally and through the projects we support.

Targets 8.4 and 8.5

Promote sustained, inclusive and sustainable economic growth, full and productive employment and decent work for all – by increasing the number of high quality, skilled jobs available and supporting business growth.

Target 11.1

Makes cities and human settlements inclusive, safe, resilient and sustainable – by providing affordable, inclusive, sustainable and low-carbon energy services to communities.

Target 17.3

Strengthen the means of implementation and revitalise the global partnership for sustainable development by mobilising private and public capital towards sustainable development in developing countries.

Partnerships

Bold and transformational steps are needed to shift the world onto a sustainable and resilient path. In recognition of this, we work in partnership with actors from the private, public and not-for-profit sectors to finance and implement clean energy projects, as well as to contribute to knowledge development and advocacy to strengthen the enabling environment for the implementation of the Paris Agreement and the 2030 Agenda.

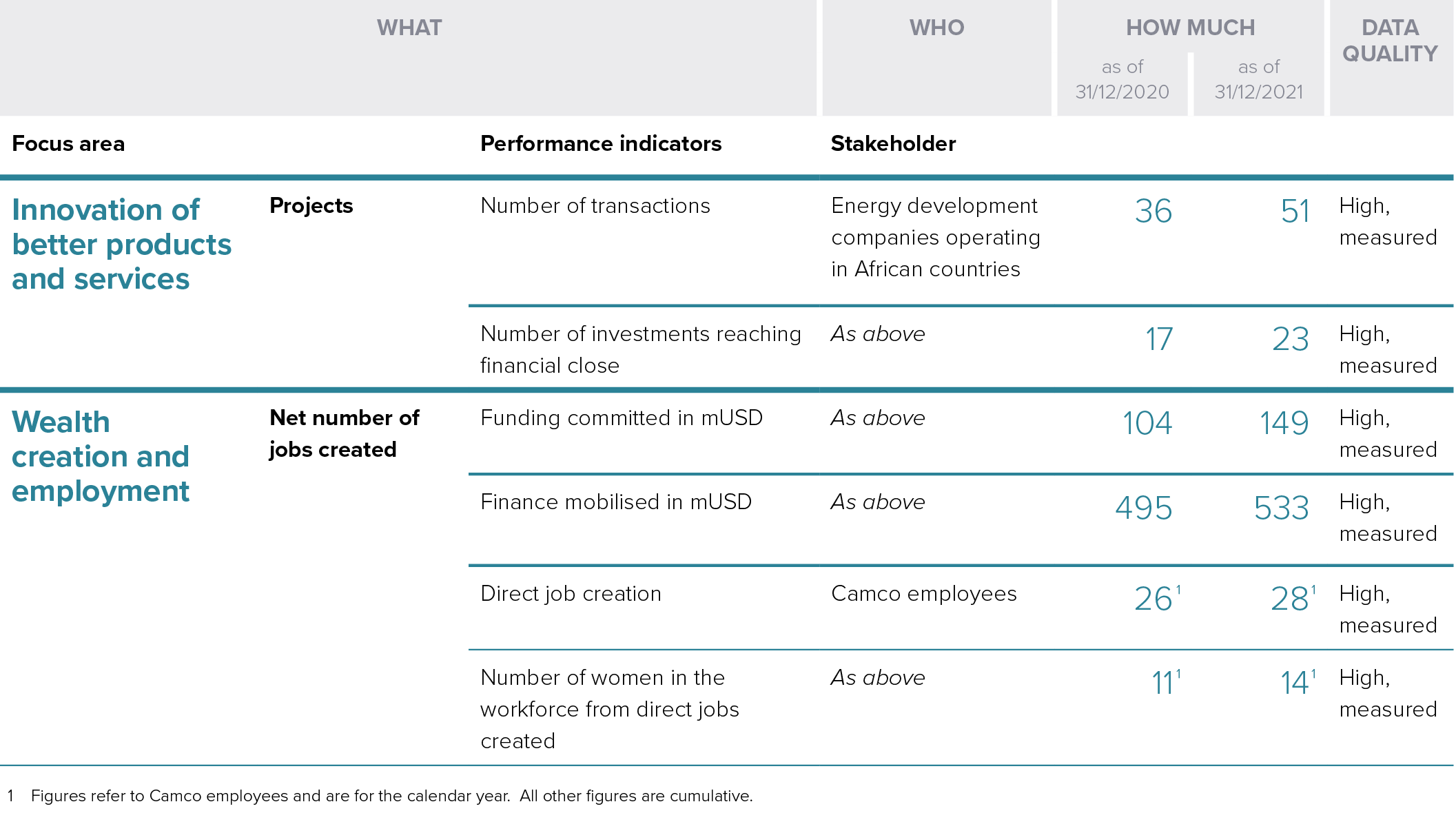

Camco brings developers, financiers and risk mitigation providers together to successfully advance renewable energy development. During 2021, Camco-managed REPP continued to work successfully with its partners to help investees scale their operations and reach financial close. This included sharing the due diligence of several REPP transactions with our partners, allowing for a quicker investment process. Working in partnership with the European Development Finance Institutions (EDFI) Electrification Financing Initiative (ElectriFI), REPP also successfully helped the first mini-grid concessionaire in Lesotho to reach financial close. And through REPP’s efforts to bring funders and risk-mitigation providers together, the first solar IPP in Burundi started operating. By the end of 2021, REPP had mobilised USD 533m climate finance of which 34% came from private sources.

During 2021, Camco continued to actively engage with governments and industry associations to advocate for improvements in the enabling environment for renewable energy development. In partnership with the Africa Mini-grid Developers Association (AMDA), Camco engaged with the energy regulator in Kenya to successfully advocate for improvements in the draft mini-grid regulations, improving the bankability of the envisaged regulatory framework.

In 2021, Camco published a report assessing the REPP portfolio’s alignment with national policy priorities in its countries of operation. The report aims to strengthen public-private collaboration and encourage other climate finance actors to strengthen their support for NDC implementation in developing and emerging markets. Camco has since integrated policy alignment assessment into REPP’s origination processes. Through its Green Climate Fund-related activities, Camco is building strong partnerships with national policy makers to better understand country climate priorities and design new (or improve existing) financing facilities to support those goals.

Camco is part of an international group of 236 asset managers with a combined USD 57.5tn in AUM that are committed to supporting the goal of net zero greenhouse gas emissions by 2050 or sooner, in line with global efforts to limit warming to 1.5°C. The Net Zero Asset Managers initiative is a formal partner of the UNFCCC’s Race to Zero campaign, and we at Camco are proud to have our investment strategy aligned with this net zero goal.

The Camco-managed REPP fund is aligned with the 2X criteria for gender lens investing, with 38% of its funding invested to date to women-owned and led companies. We provide our investees with gender equality training and assist them in establishing gender action plans to improve gender equality within their operations and project implementation. REPP is also working in partnership with the 2X Collaborative to increase equitable climate finance flows through knowledge development and advocacy. In 2022, Camco will be working with the 2X Collaborative to organise Africa and SIDS-focused online forums exploring at how companies (and by extension, their funders) can better target women customers through distributed renewable energy business models and operations.